Here’s the thing about the music business: it rarely stands still for long. But the pace of change over the last decade has been extraordinary. Ownership has given way to access, physical formats have faded into niche territory, and streaming has become the default way most people experience music.

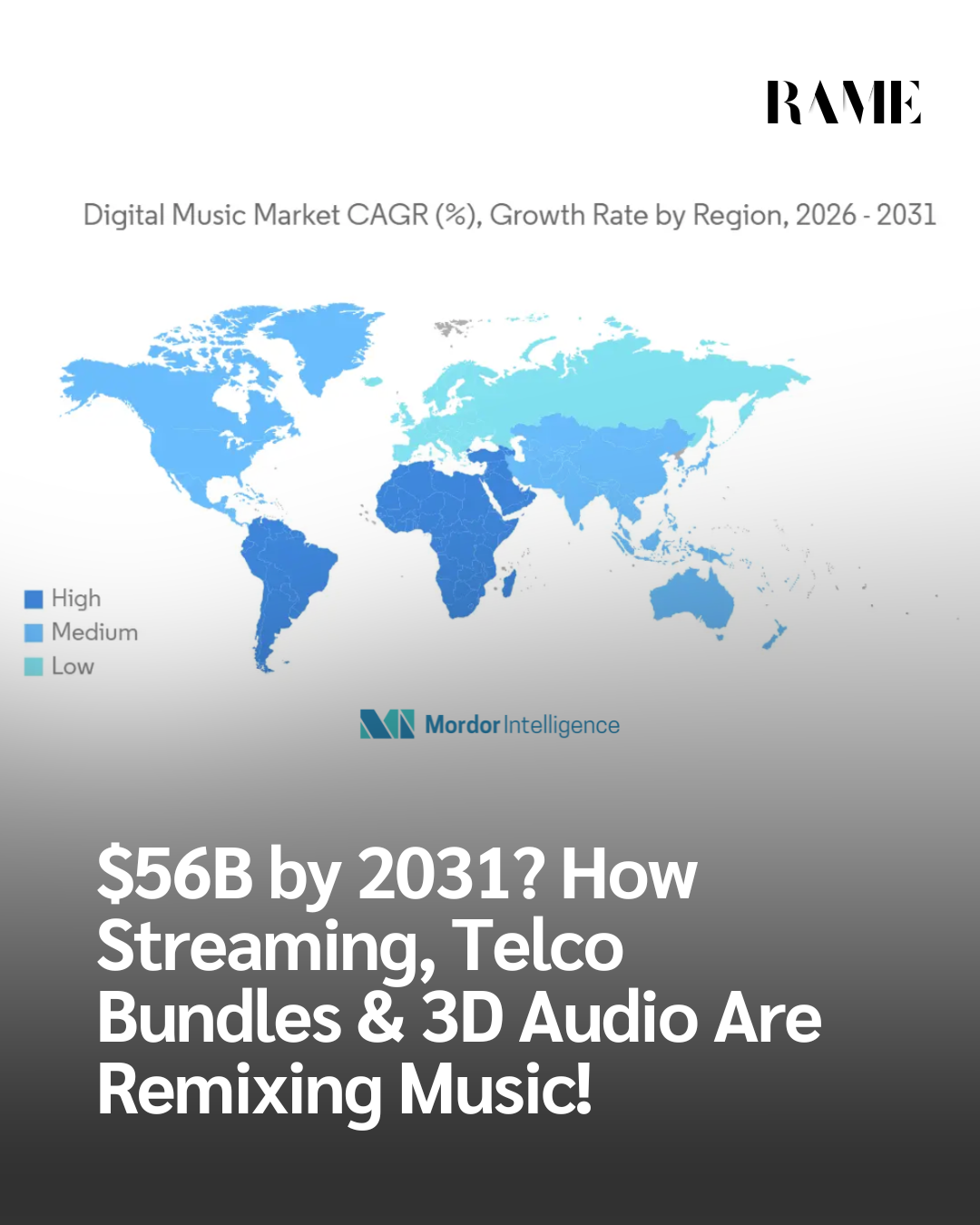

Now, fresh data from Mordor Intelligence suggests this transformation is far from over. According to its latest industry report, the global digital music market is on track to reach USD 56.22 billion by 2031, up from USD 36.27 billion in 2025, growing at a compound annual growth rate (CAGR) of 7.58%.

The growth story is not just about more people streaming more songs. It’s about how music is being embedded into everyday digital life, from smartphones and cars to smart speakers and telecom bundles.

From Ownership to Access: The Structural Shift in Music Consumption

The digital music industry has decisively moved away from ownership models like CDs and permanent downloads. Instead, access-based platforms dominate, offering users instant entry to vast libraries for a monthly fee.

This shift has fundamentally changed consumer behavior. Listeners increasingly expect:

- Unlimited, on-demand access

- Personalised recommendations

- Offline playback

- Seamless listening across devices

According to Mordor Intelligence, this transition is the single biggest driver behind sustained market expansion, as streaming creates predictable, recurring revenue for platforms while lowering the barrier to entry for users.

As the International Federation of the Phonographic Industry (IFPI) has noted in recent global music reports, “Streaming now accounts for more than two-thirds of recorded music revenues in most major markets.” That structural change has effectively rewired how the entire industry makes money.

Streaming Services Lead Digital Music Market Growth

Streaming is no longer just one segment of the market. It is the market.

Platforms built around on-demand access and curated playlists have replaced downloads as the primary revenue engine for the industry. Subscription-based income provides stability that the music business historically lacked, especially compared to the boom-and-bust cycles of physical sales.

Beyond traditional listening, streaming platforms are expanding into:

- Live-streamed concerts

- Exclusive digital events

- Artist-to-fan engagement tools

These features allow artists to monetise beyond recorded tracks while strengthening user loyalty.

As one senior analyst at Mordor Intelligence put it in the report:

“Streaming has evolved from a distribution channel into a complete digital ecosystem for music discovery, performance, and fan engagement.”

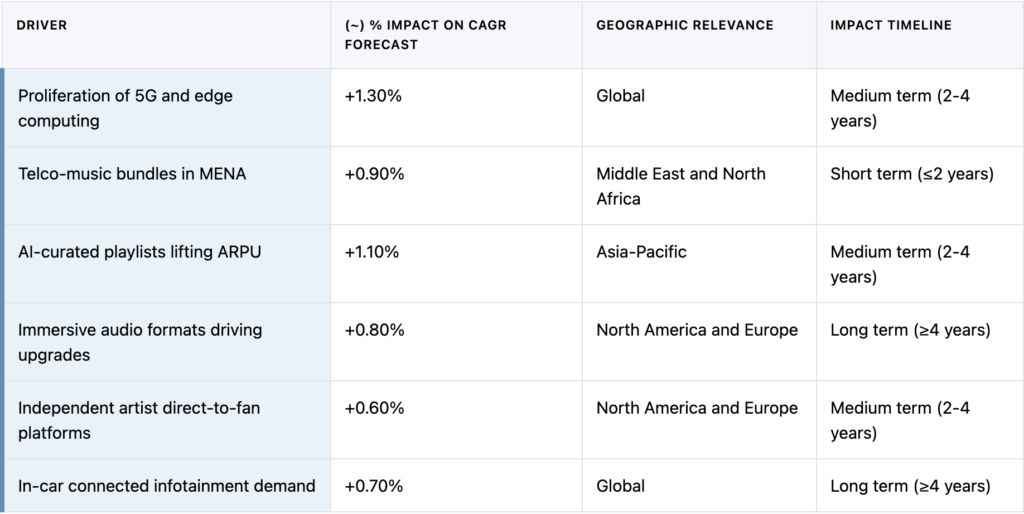

Telco Bundles: The Quiet Growth Engine

One of the less visible but highly influential growth drivers is the role of telecom companies.

Mobile operators increasingly bundle music subscriptions with data plans, making premium services more accessible, particularly in emerging markets. These partnerships:

- Reduce upfront cost for consumers

- Simplify payments via carrier billing

- Increase retention for both telcos and platforms

In regions where credit card usage is limited, carrier billing is especially powerful. It allows millions of users to subscribe using prepaid balances or monthly mobile bills.

This strategy is a major reason digital music adoption is accelerating in parts of Asia, Africa, and Latin America.

AI and Personalisation: Why Engagement Keeps Rising

Artificial intelligence is now central to how music platforms operate.

Recommendation engines analyse listening habits to suggest songs, artists, and playlists tailored to each user. This personalisation drives longer listening sessions and higher satisfaction.

From a business perspective, this matters because:

- Higher engagement boosts ad revenue on free tiers

- Personalised experiences increase conversion to paid plans

- Users are less likely to churn

In short, algorithms are not just improving discovery. They are directly shaping the economics of the digital music market.

Immersive Audio and the Push Toward Premium

Another emerging trend is immersive audio, including spatial and object-based sound formats.

These technologies promise a richer, more three-dimensional listening experience, especially when paired with high-end headphones and compatible devices.

Music platforms increasingly position immersive audio as a premium feature. The logic is simple: better sound equals higher perceived value, which justifies higher subscription prices.

This supports two critical goals for platforms:

- Increasing average revenue per user

- Differentiating paid tiers from free alternatives

As hardware improves and immersive formats become standard, this segment could play a key role in the next phase of revenue growth.

Market Segmentation: A Global, Multi-Platform Industry

The digital music market now spans multiple dimensions:

By service type:

Downloads, websites, mobile apps, social media, on-demand streaming, live streaming

By revenue model:

Subscription-based, advertisement/freemium, pay-per-download

By platform:

Mobile devices, desktops, smart speakers, connected cars

By content:

Audio music, podcasts, live recordings, music videos

By end-user:

Individual consumers, commercial venues, automotive systems

By geography:

North America, Europe, Asia-Pacific, South America, Middle East & Africa

The rise of connected cars and smart speakers is particularly notable, turning music into an ambient service rather than a deliberate activity.

Key Players Shaping the Digital Music Ecosystem

Several major companies dominate the global landscape:

- Spotify Technology S.A.

- Tencent Music Entertainment Group

- iHeartMedia Inc.

- TuneCore Inc.

- LANDR Audio Inc.

These platforms compete not just on catalogue size, but on user experience, creator tools, data intelligence, and ecosystem partnerships.

How Digital Music Fits Into the Bigger Audio Economy

The digital music boom is part of a wider shift across audio markets.

Related industries are also expanding rapidly:

- Audiobook market: projected to reach USD 14.34 billion by 2031

- Audio streaming market: forecast to exceed USD 100 billion by 2030

- Musical instruments in India: growing at over 12% CAGR

Together, these trends suggest a global audience increasingly comfortable with audio-first digital experiences.

The Bigger Picture: Why This Market Still Has Room to Grow

What this data really shows is not just growth, but resilience.

Music has successfully adapted to:

- New devices

- New business models

- New consumer expectations

The industry now benefits from predictable subscription income, global distribution, and deep integration into daily digital life.

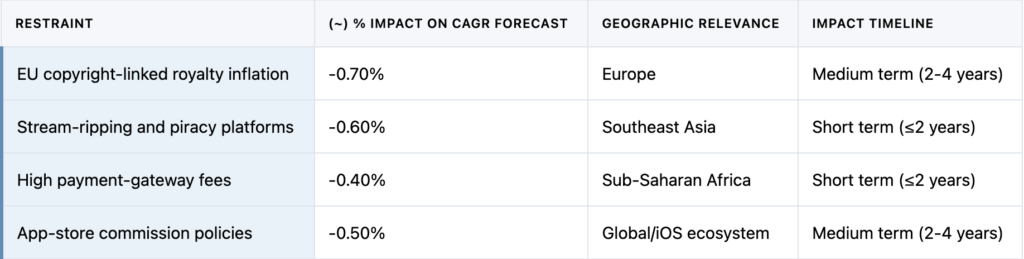

As Mordor Intelligence concludes, long-term growth will be driven by three forces:

- Continued streaming innovation

- Deeper telco and platform partnerships

- Premium experiences like immersive audio

The digital music market is no longer about replacing physical formats. It’s about becoming a permanent layer of the global digital economy.

And once music becomes infrastructure rather than a product, its growth potential looks far less finite than anyone once imagined.