The moment music meets the big screen and the checkout

Here’s the thing: the places people discover and buy music are changing fast and not just on TikTok. In 2025-26 we’re seeing the streaming TV set, social platforms and in-app shops converge into new, high-value touchpoints for artists and labels. That creates bigger opportunities and new risks for music campaigns that want reach and revenue without wasting budget. This piece unpacks the evidence, shows concrete examples from recent campaigns, and gives practical moves for artists, managers and music marketers as they plan for 2026.

1) Connected TV: reach + risk, the new must-buy (and why measurement matters)

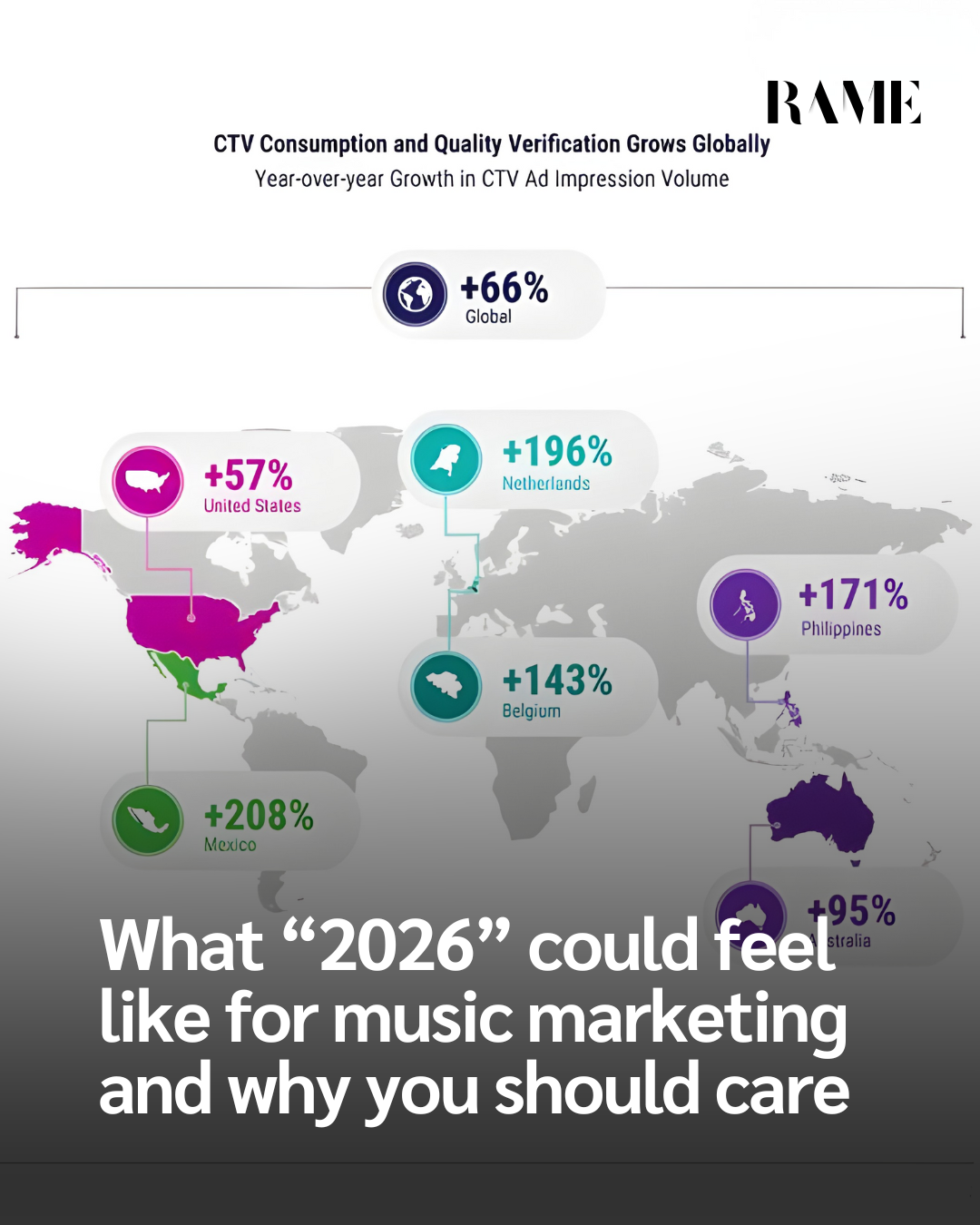

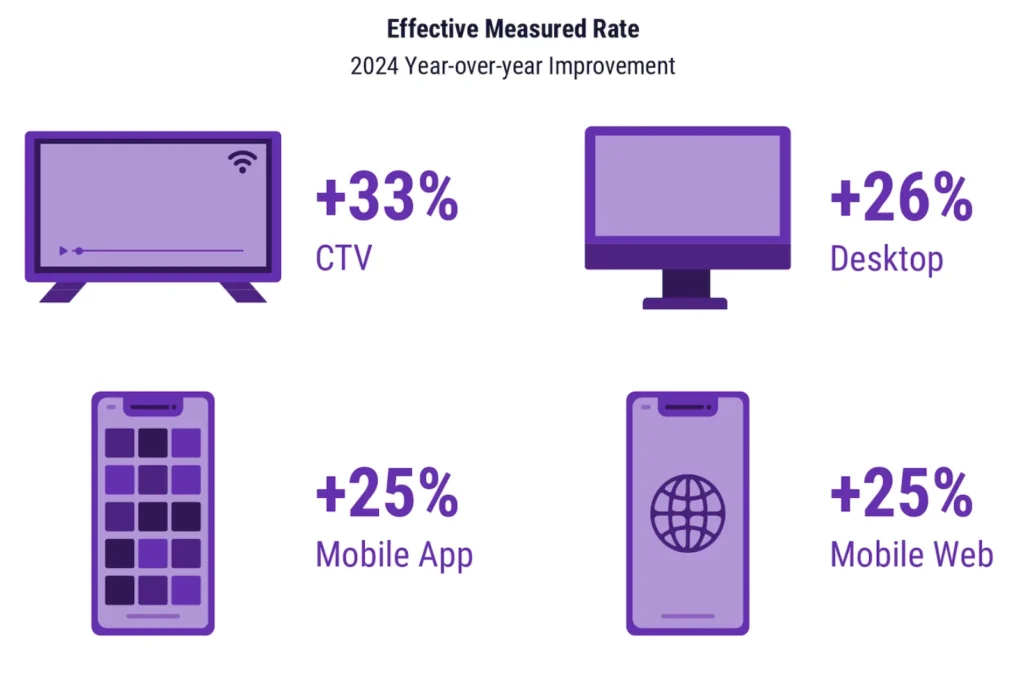

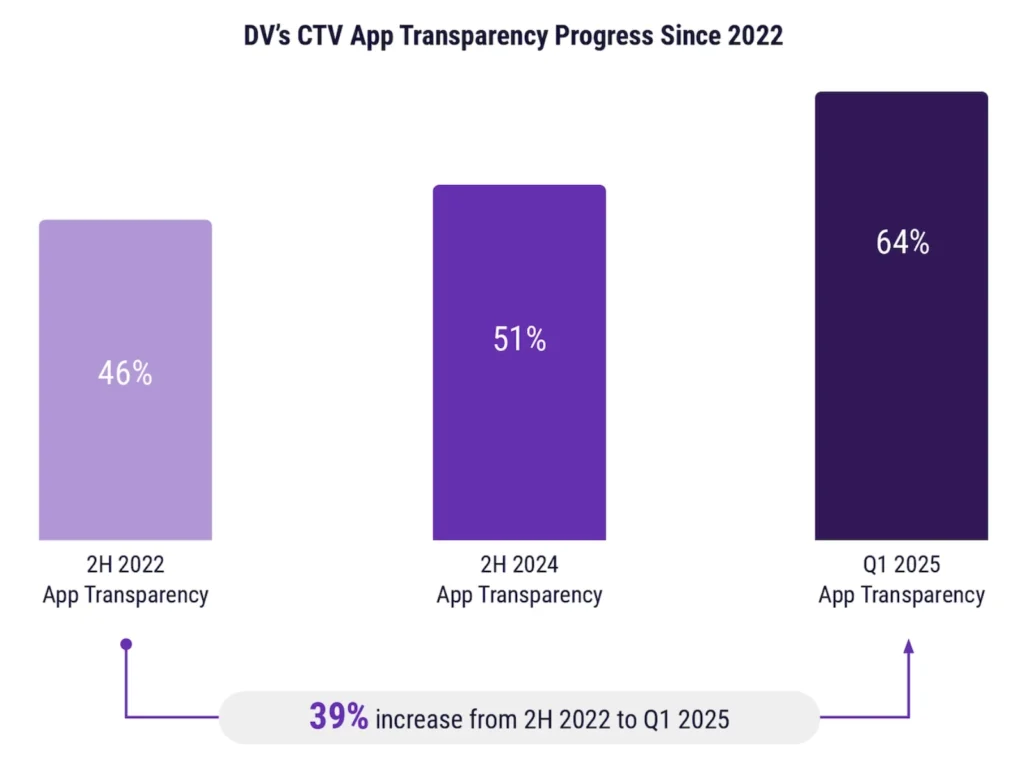

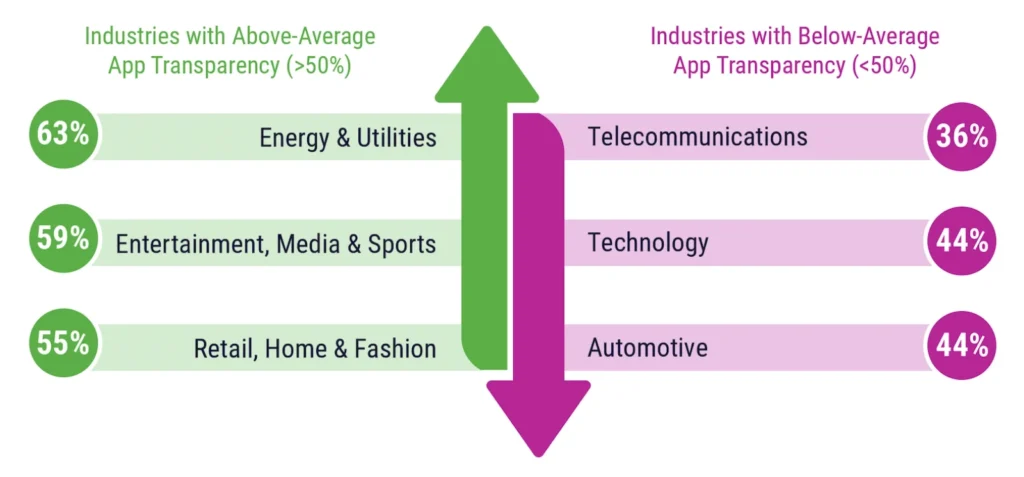

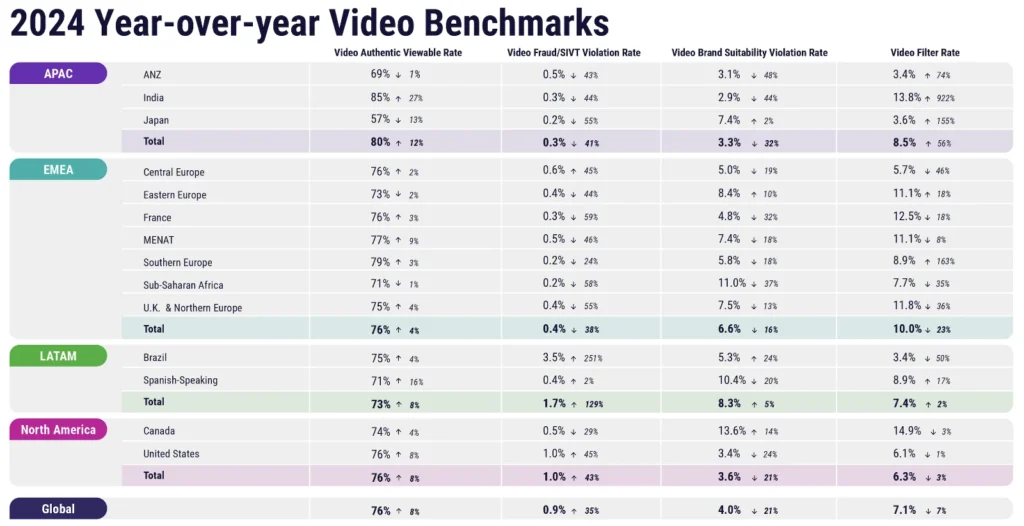

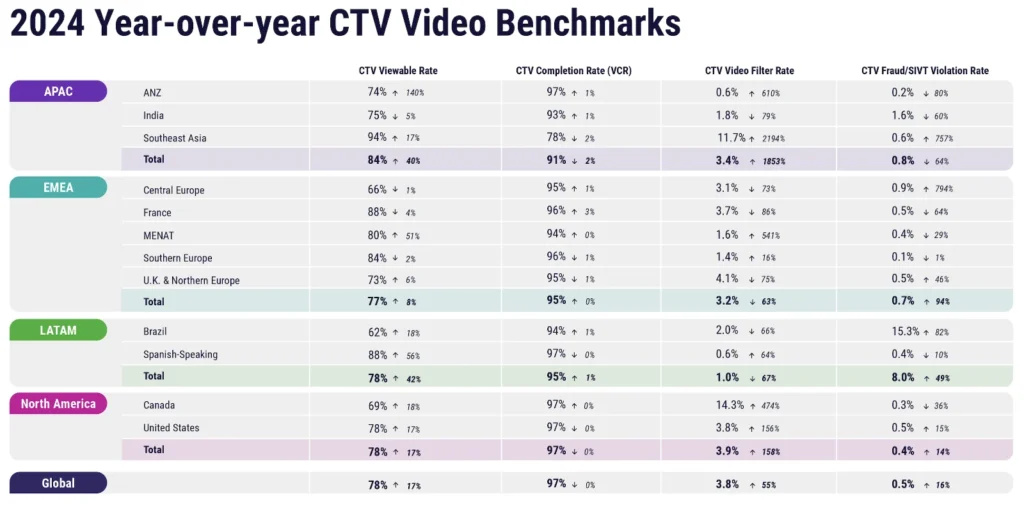

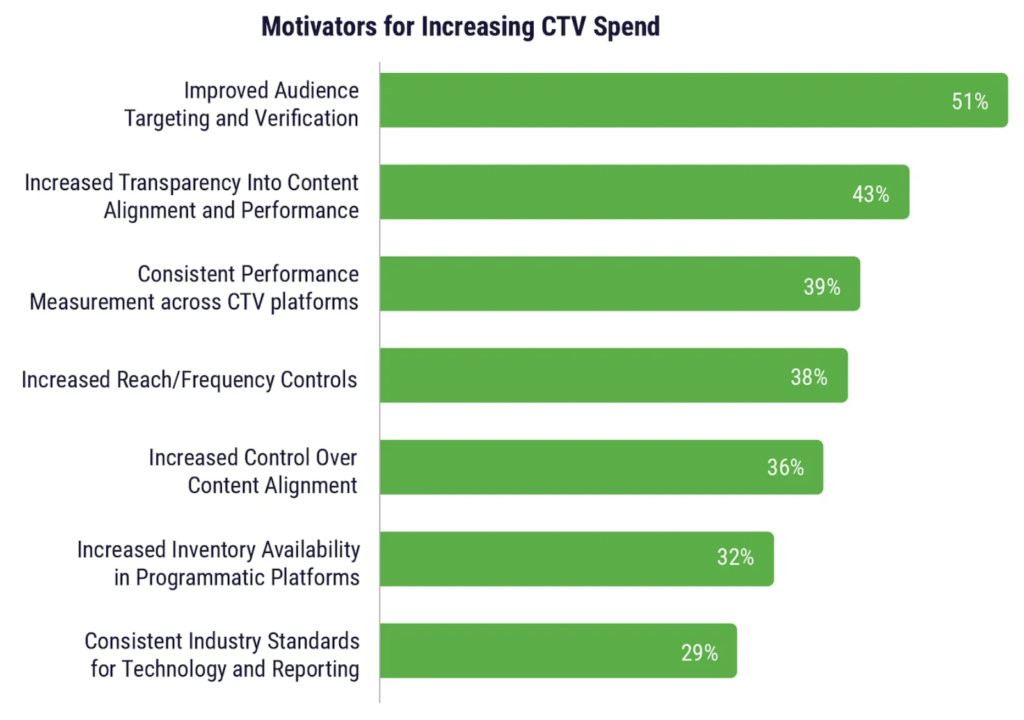

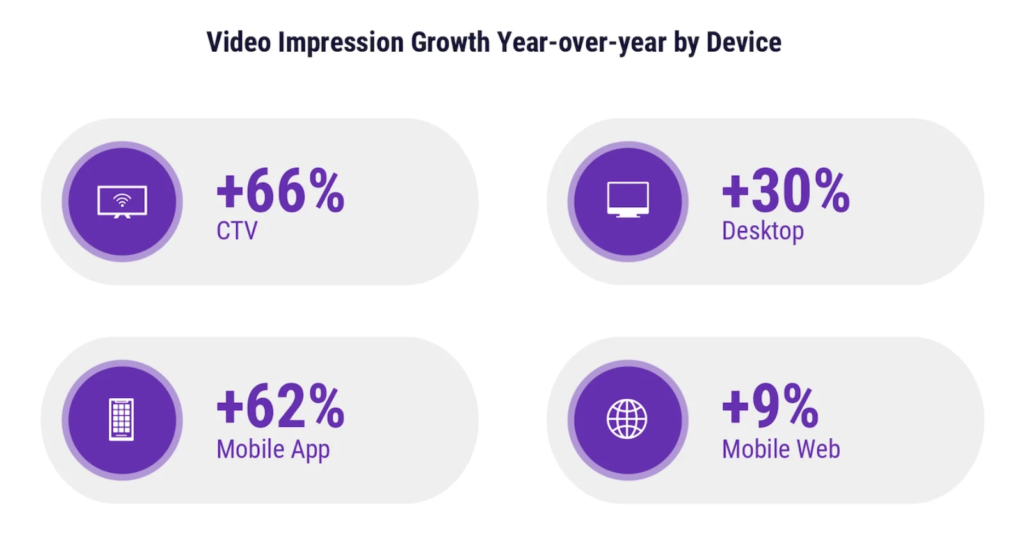

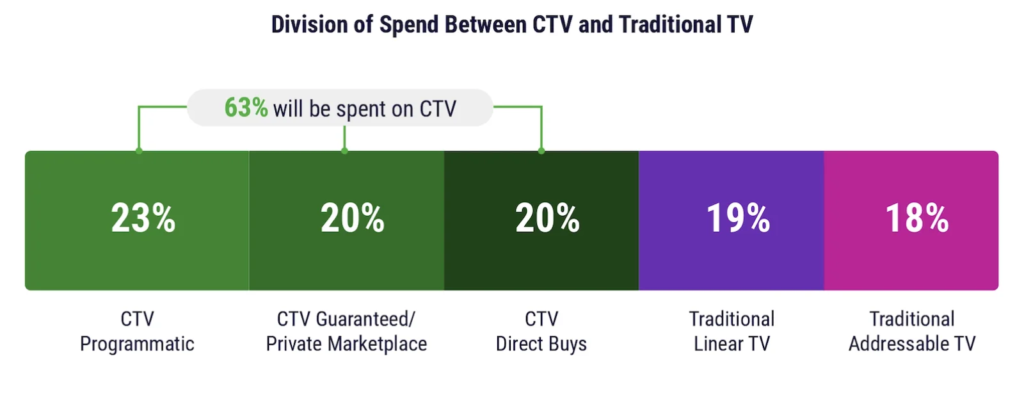

DoubleVerify’s Global Insights found big growth in CTV: ad impression volume rose sharply (66% year-over-year in 2024) and the majority of marketers see CTV as outperforming baselines yet transparency and fraud remain problems. In their marketer poll, 54% said they increased CTV spend over the past year, and many non-CTV buyers plan to start investing in the channel within 12 months. doubleverify.com

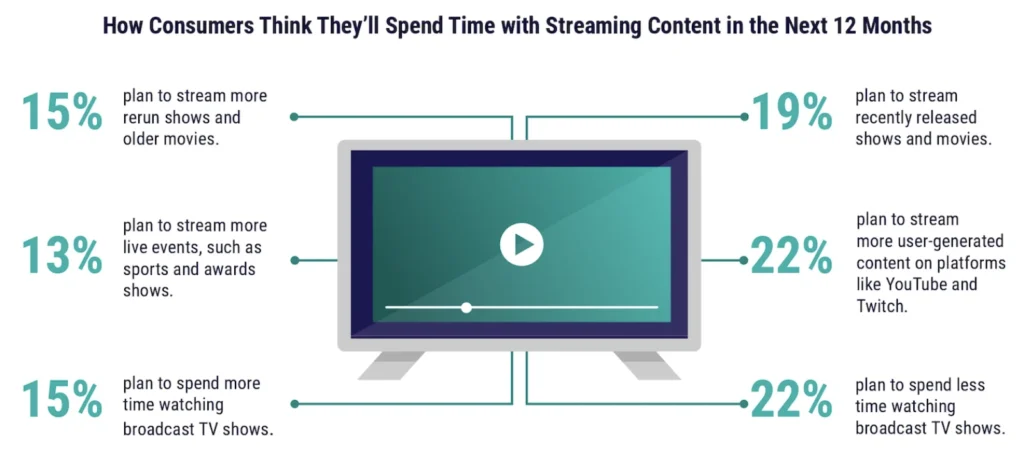

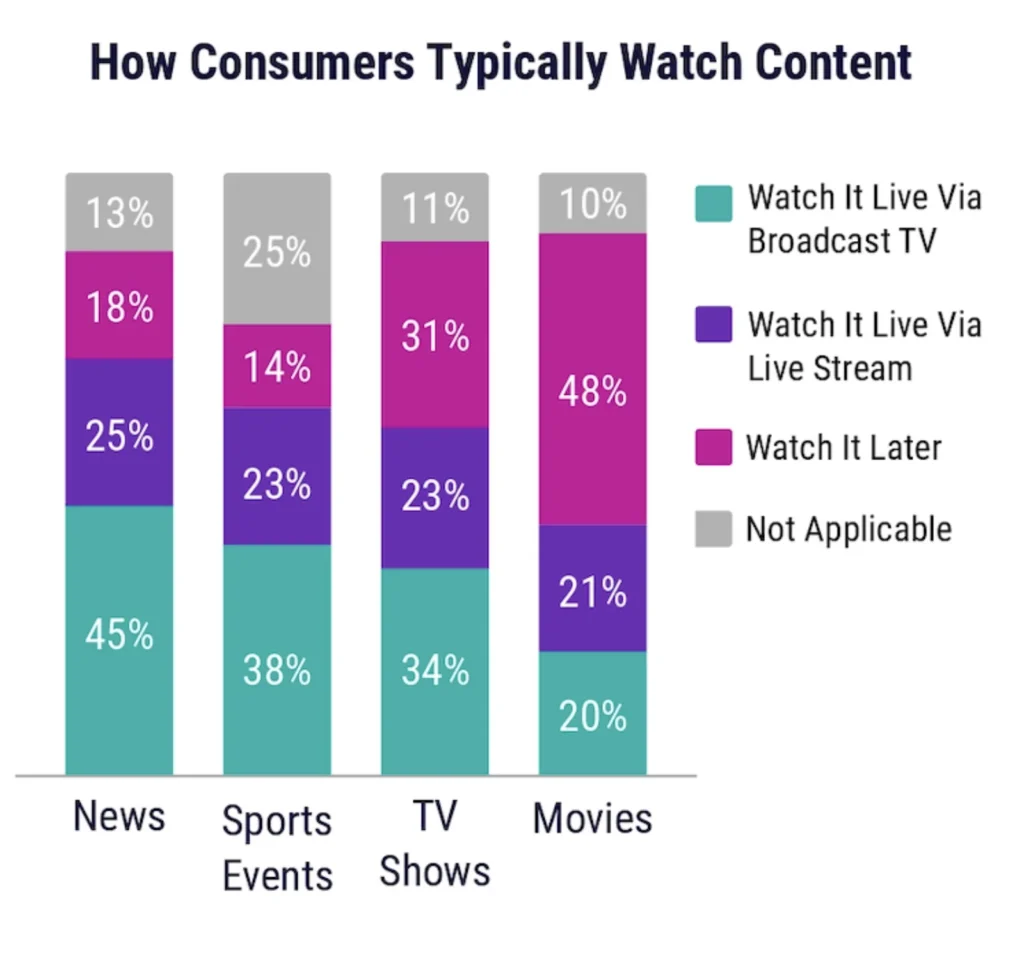

What that means for music: premium CTV placements let labels and brands reach audiences in long-form, attention-rich environments think mid-rolls during a hit show or a pre-roll before a documentary about an artist. But the platform matters: marketers named YouTube, Netflix and Amazon among the key streaming drivers for this uptake. Media buyers should therefore balance the size and quality of CTV reach with safeguards around viewability and inventory authenticity.

Quote to anchor the risk: “CTV has become a centerpiece of digital video strategy… it is still a maturing medium,” said Mark Zagorski, CEO of DoubleVerify, pointing to transparency gaps and fraud as the main challenges. doubleverify.com

Practical takeaway: if you’re planning a big album campaign in 2026, allocate a meaningful CTV line but demand app-level transparency, prefer authenticated environments (platforms with device verification), and push for verified measurement standards in contracts.

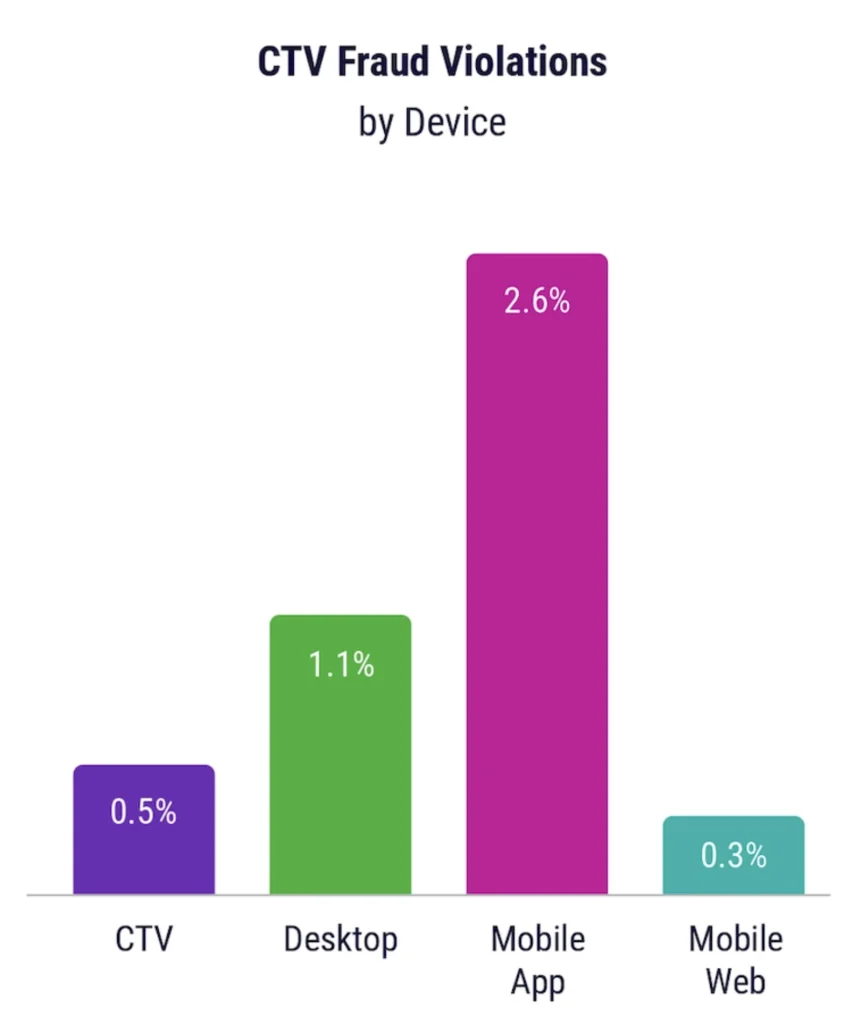

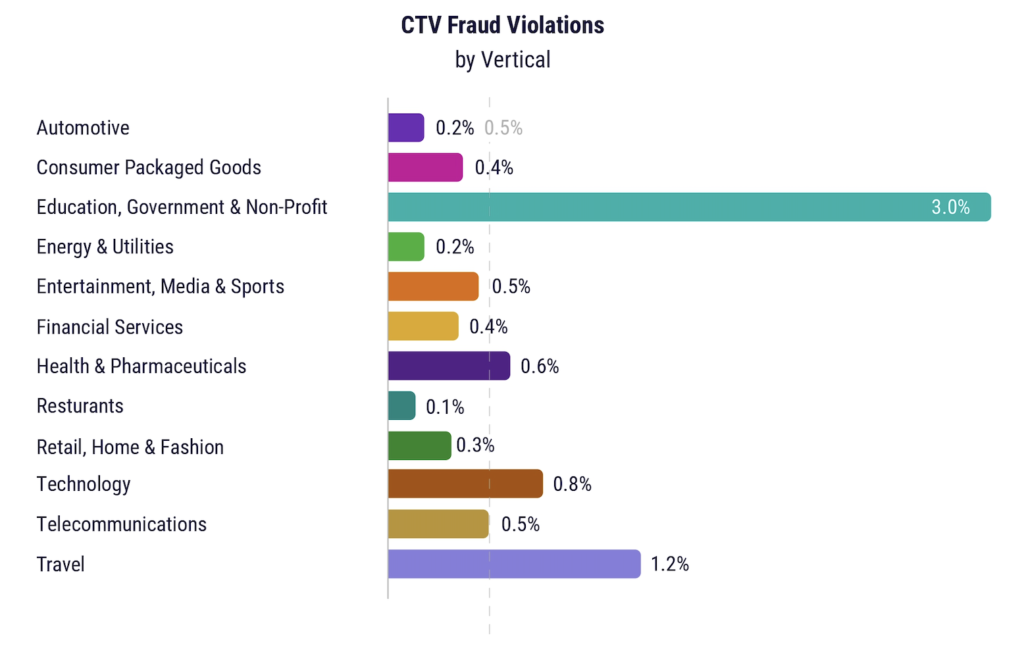

2) Fraud and authentication: the plumbing matters more than you think

Fraud isn’t an abstract line-item it eats budgets. DoubleVerify’s research flagged bot generated impressions and “TV-off” scenarios as real drivers of wasted spend. Industry collaborations are starting to move the needle: Roku and DoubleVerify reported a measurable drop in falsified ad impressions after rolling out device level watermarking and joint fraud defenses. James Kelm of Roku described the Advertising Watermark as “instrumental” in curbing spoofing.

Practical takeaway: insist on authenticated inventory (watermarked or otherwise provably genuine) for CTV buys tied to music campaigns especially for high CPM placements attached to premieres, trailers, or branded content.

3) Social commerce in Asia (and why artists with regional fanbases should care)

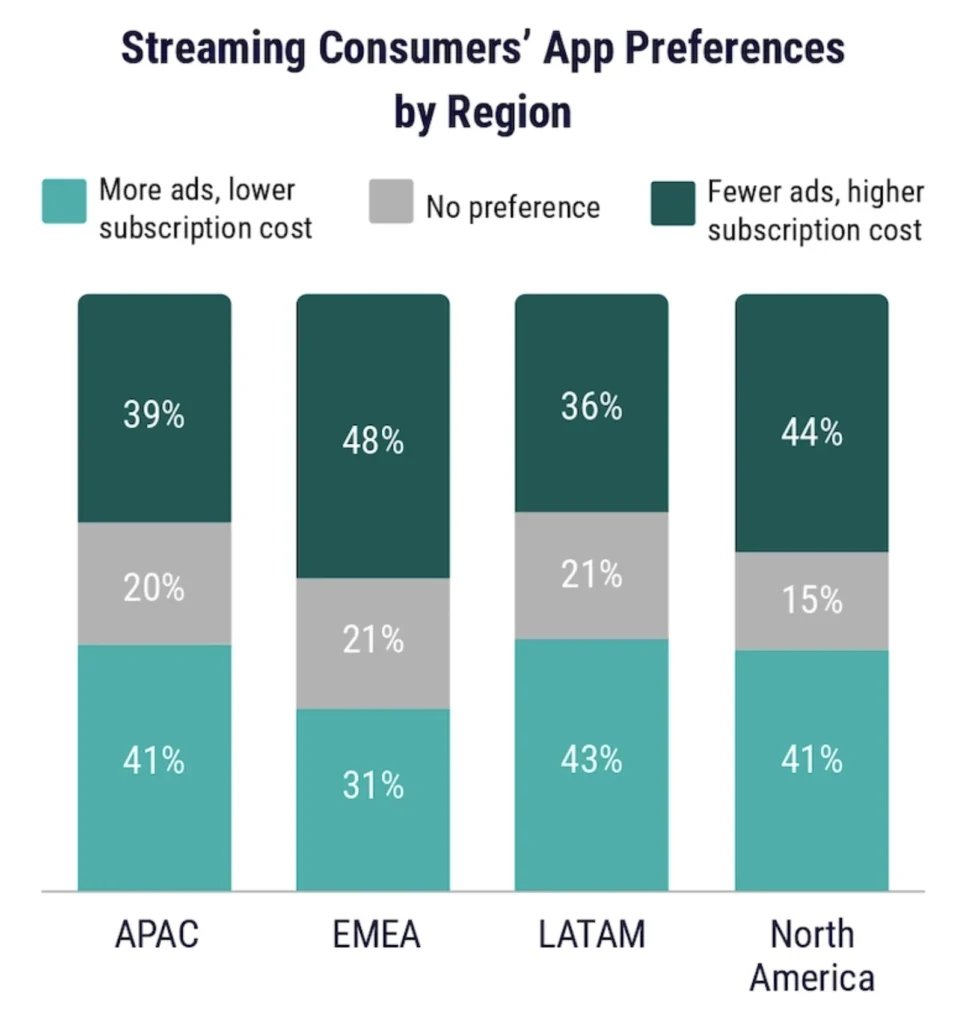

Social commerce is no longer experimental it’s mainstream in many Asian markets. Live, shoppable streams and in-platform storefronts have exploded in Southeast Asia and India; brands and creators there are converting discovery into immediate purchases via TikTok Shop and similar features. Recent regional data and platform reports show livestream shopping penetration and GMV growth led by markets such as Indonesia, Philippines and India.

Example that maps directly to music marketing: Tate McRae’s album release event on TikTok paired a global livestream with TikTok Shop so fans could buy picture discs, vinyl and merch while watching the performance. That’s a direct revenue model for releases and bundles and it can work for mid-tier acts as well as stars, when the logistics are right.

Practical takeaway: if an artist has concentrated fanbases in India, the Philippines or Indonesia, build shoppable experiences into the release plan: timed livestreams, exclusive physical drops, or creator affiliate campaigns. Local payment, fulfilment and pricing must be dialled in.

4) Case studies: what recent music campaigns teach us

Tate McRae shoppable livestream playbook: TikTok’s in-app album launch put commerce and content in the same UX: fans watched, engaged and bought without leaving the platform. That’s an efficient funnel for merch and limited editions; it also amplifies pre-orders and helps count direct conversions.

Lola Young premium placement + search activation: Lola Young’s streaming and press cycle shows how a mid-tier breakout can be amplified with cross-platform presence (social virality, earned press, streaming playlisting and broadcast appearances). CTV and premium streaming placements around a release for example a mid-roll on a mainstream streaming film or show can increase reach beyond social virality, but they must be supported by measurement and retargeting to convert interest into fans and sales. Coverage in outlets like The Guardian and specialist sites charted this trajectory.

5) Strategy checklist for labels and artist teams in 2026

- Mix reach with proof: combine CTV buys (for broad, attentive reach) with platform measurement partners who can validate device and view authenticity. Ask for app-level transparency and authenticated inventory.

- Design shoppable moments: plan at least one shoppable moment around a release a livestream, a platform exclusive bundle, or an affiliate push especially if an artist’s streaming analytics show high engagement in Asian markets.

- Prioritize context: place ads where the program context aligns with the artist’s brand and audience (genre, tone, cultural fit). Marketers in DV’s survey said they’d pay premium CPMs for professionally produced, contextually appropriate placements.

- Localize commerce and fulfillment: if you target Philippines/India/Indonesia, local payment rails and fulfilment partners are critical to avoid abandoned carts during livestreams. Use marketplace partners who already have logistics in those regions.

- Measure holistically: blend CTV, social and streaming metrics into a unified view test incremental impact (did CTV lift streams or ticket sales?) and use A/B tests and verified third-party measurement where possible. Nielsen and other measurement firms emphasize the need to integrate CTV into broader media measurement to justify spend.

6) A short note on creative: make the format earn its place

Mid-rolls and livestreams aren’t the same as a TikTok. Creative should be built for the screen and the moment. For CTV, think story-driven 15-30s spots that reward longer attention; for shoppable livestreams, design scarcity, clear CTAs and simple checkout flows. Pull fans from passive viewers into owned channels email lists, pre-save links and merch drops so your campaign keeps value beyond the immediate buy.

Where to place your bet (and what to avoid)

If 2024-25 taught us anything, it’s that the biggest wins come from treating distribution and commerce as a single design problem. In 2026, the pragmatic play for music teams is to pair high-quality CTV placements (with authenticated, transparent measurement) and targeted social commerce activations in markets where conversion is proven. Don’t chase placement for its own sake: demand verification, optimise for context, and design commerce that fits the platform otherwise you’ll be spending without knowing whether it moved the needle.

Final provocation: a million view TikTok clip still has far more value if it converts a fan into a buyer or a concert goer. Build funnels that respect where attention happens and where money changes hands because discovery that can’t be converted is only half a win.