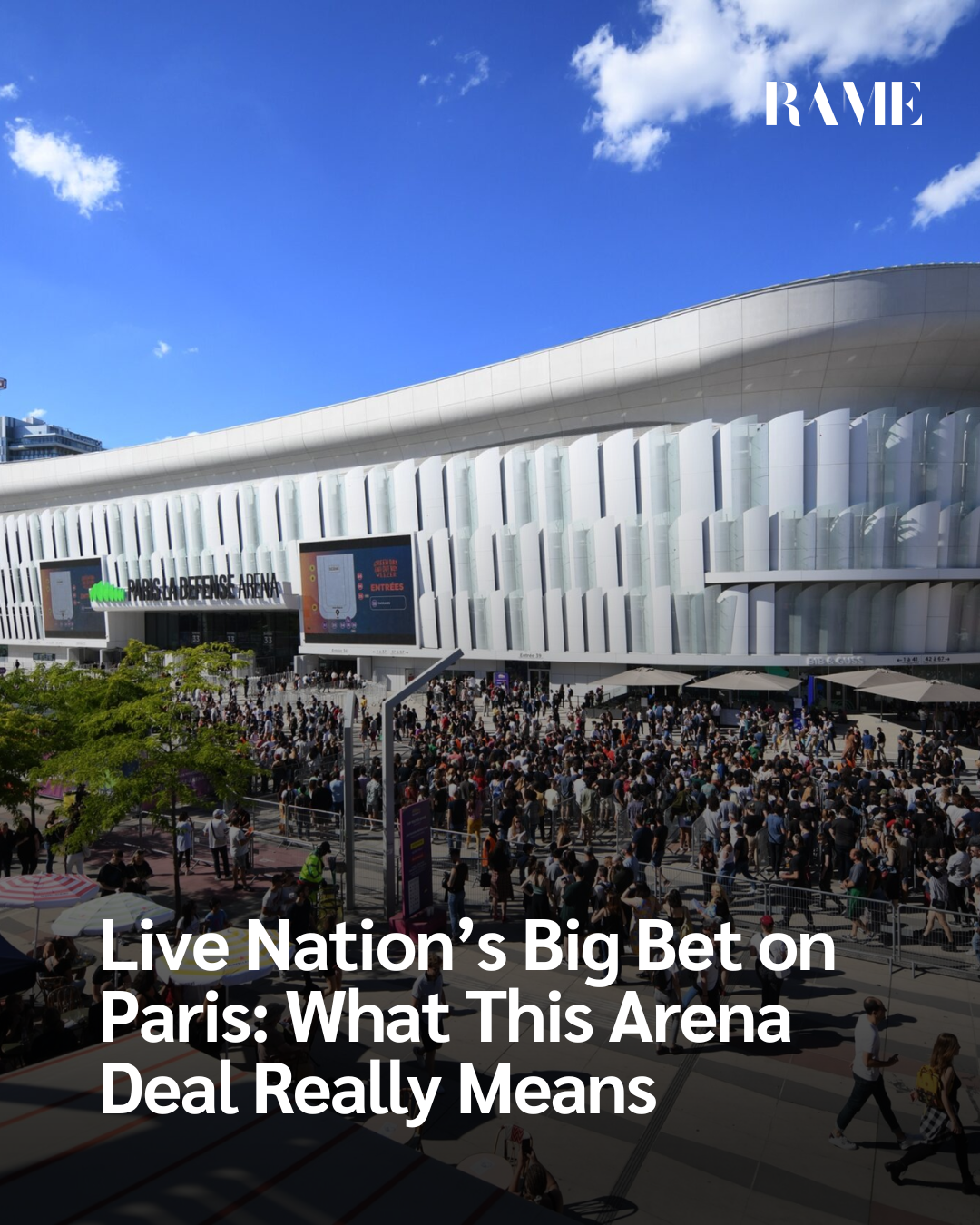

Paris, France – Live Nation, the U.S. live‑entertainment giant behind massive tours worldwide, just pulled off one of the most consequential moves in European concert history. It has agreed to acquire Paris La Défense Arena, Europe’s largest indoor venue, from French holding company Ovalto, setting the stage for a new era in live entertainment for Paris, the Île‑de‑France region, and the broader European market.

This isn’t just another real‑estate buy. It’s a strategic push that could reshape how major shows are booked and produced on the continent, with ripple effects for artists, promoters, and local economies.

A Venue With a Track Record

Opened in 2017 in Nanterre, just west of central Paris, La Défense Arena has quickly become one of Europe’s most versatile and high‑capacity venues. With a modular design, it holds up to 45,000 people for concerts, more than any other indoor venue in Europe and can also be configured for rugby, basketball, trade shows, and more.

Over the years it’s played host to top‑tier global acts from Taylor Swift and The Rolling Stones to Kendrick Lamar and Dua Lipa and major international sporting events, including competitions during the 2024 Olympic Games.

For Live Nation, that track record makes La Défense Arena a rare prize: a proven, big‑room destination in the heart of one of Europe’s richest cultural capitals.

What Live Nation Is Saying

Live Nation’s formal announcement made it clear the company sees more than just old value in the bricks and mortar.

“Our ambition is simple: to make Paris La Défense Arena a venue that welcomes more productions, with the finest facilities for artists, all event producers and promoters and, above all, the audience,” said Angelo Gopee, Managing Director of Live Nation France.

Gopee emphasised that upgrades will go beyond acoustics and equipment, the company is positioning the venue as a driver of local inclusion, educational access, and broader cultural engagement.

The deal is pending approval from the French Competition Authority, meaning it’s not final yet, but the vision Live Nation laid out hints at long‑term planning rather than short‑term profit.

What the Sellers Think

Ovalto and its leadership have been enthusiastic about the transition.

“Ovalto has created a venue that has become unique in Europe in less than ten years,” said Frédéric Longuépée, President of Paris La Défense Arena. “The arrival of Live Nation promises exciting new opportunities for our clients, employees, and partners.”

Jacky Lorenzetti, President of Ovalto and owner of the rugby club Racing 92, the team that originally developed the arena echoed that sentiment, noting that Live Nation’s expertise could drive further growth.

A Broader Expansion Strategy

The Paris deal is hardly Live Nation’s only global move. In recent months the company has struck deals around the world:

- A majority interest in Movistar Arena in Santiago, Chile.

- An operating agreement for Impact Arena in Bangkok.

- A pending acquisition of Royal Arena in Copenhagen.

- Partnerships and venue launches in South Africa and Nigeria.

- New operations at Arena Cañaveralejo in Cali, Colombia, with Mexican and Colombian promoter partners.

These moves show a clear pattern: Live Nation isn’t just booking tours anymore. It’s building a network of flagship venues that can anchor touring circuits and local programming across continents.

What This Means for France

What’s striking about the Paris deal is how it contrasts with the traditional French model, where many venues are managed under public service delegations rather than private ownership. Live Nation’s acquisition could recalibrate how big shows are booked, marketed, and produced in France – with potential benefits but also competitive tensions.

There’s also an economic angle: upgrading one of the region’s biggest entertainment hubs may attract more artists and boost tourism, especially outside the traditional peak summer months.

The Big Picture

Here’s the thing: acquiring real estate isn’t inherently transformative. What matters is how Live Nation leverages its global scale, data on touring demand, and relationships with artists and promoters.

If the company delivers on its promise to bring more productions year‑round and makes La Défense Arena a hub for cultural events beyond concerts, this could be a turning point for European live entertainment.

If not, it could expose tensions between private promoters and local markets that still value public access and cultural diversity.

Either way, this deal is a signal of how global entertainment companies are reshaping live events in a post‑pandemic world.