A new report reveals that just four companies control the lion’s share of major music festivals across the continent. What this means for artists, independent promoters, fans and cultural diversity goes far beyond balance sheets.

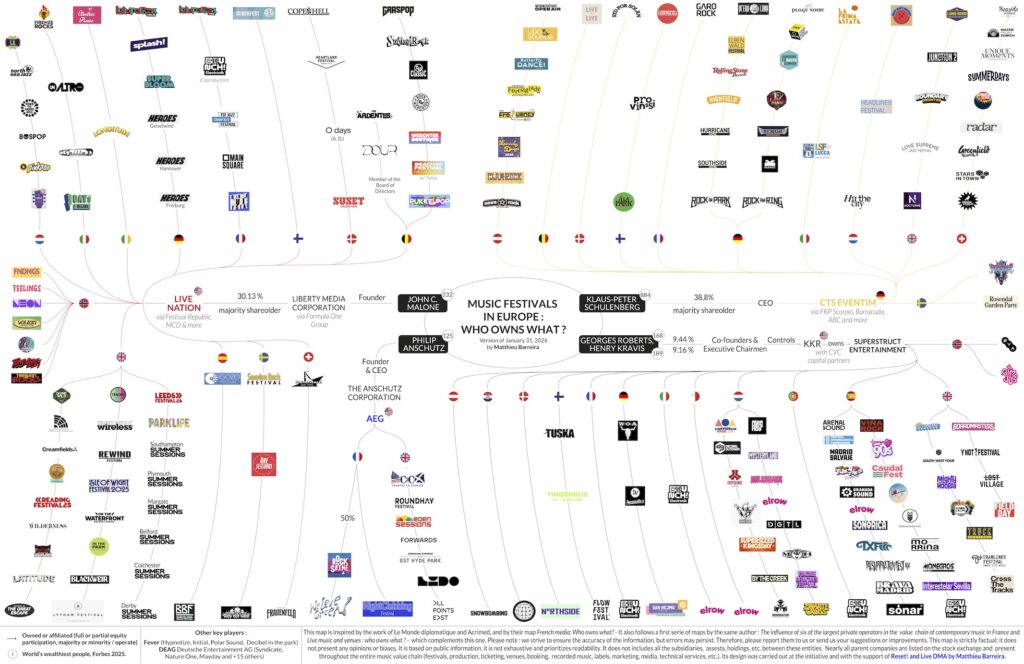

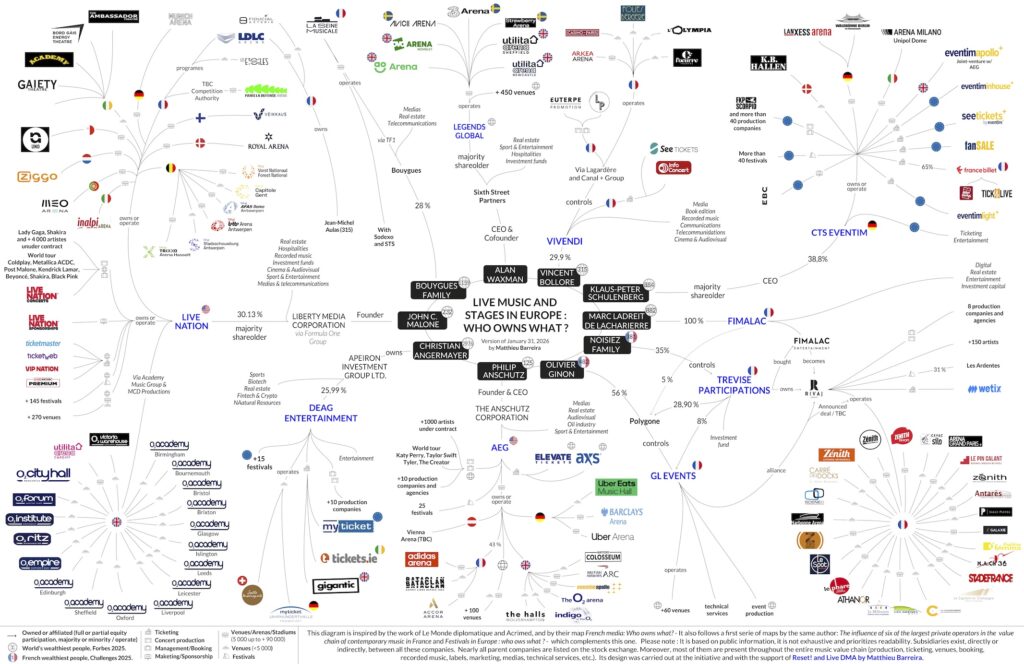

In early February, industry groups Live DMA and the Reset! network published research mapping ownership of European music festivals and venues. The findings show a striking level of consolidation: more than 150 of the largest festivals are linked to just four corporate giants. That concentration raises tough questions about market power, cultural diversity, consumer choice and the future of the live music ecosystem in Europe.

The Four Giants Shaping Europe’s Festival Landscape

According to the live music ownership maps released by Live DMA and Reset!, these companies dominate festival ownership:

- Anschutz Entertainment Group (AEG) – part of the US-based Anschutz Corporation, AEG is involved in major European festivals and owns key venues like the O2 Arena in London and Mercedes‑Benz Arena in Berlin.

- Live Nation Entertainment – arguably the biggest player in live music globally, with around 120 subsidiaries in Europe generating billions in turnover and owning or operating a long list of festivals and venues.

- CTS Eventim – a German ticketing and entertainment company with significant stakes in festivals, ticketing platforms and venue operations across Europe.

- Superstruct Entertainment – a British live entertainment company that operates more than 80 festivals across ten countries, now backed by private equity firm KKR (with CVC as co‑investor).

Together, these four names appear as the controlling interests behind the bulk of Europe’s biggest music events from mainstream summer festivals to multi‑day cultural showcases.

Why Ownership Maps Matter

Here’s the thing: the live music industry has long been opaque about who really runs what. Audiences see festival brands, artist lineups and stages full of fans but not the ownership structures behind the scenes.

The mapping project aims to change that by visually laying out the value chain from festivals to venues and ticketing platforms showing how concentrated control has become.

A separate set of maps focused on music venues shows that while small and medium‑sized venues tend to remain independent or locally owned, arenas and stadiums are increasingly under corporate control.

The Debate Around Consolidation

Critics argue that this consolidation threatens cultural diversity and competition. Emma Rafowicz, vice‑chair of the European Parliament’s Committee on Culture and Education, summed up the concern:

“More than ever, the growing concentration in the live music ecosystem … threatens cultural diversity and the independence of artists and producers.”

She called for policy action to limit vertical integration and restrict ownership of multiple events by single operators.

Such concerns aren’t limited to the festival stage. A 2023 European Parliament question highlighted how concentrated ownership across value chain components from artist management to ticketing could distort competition and inflate ticket prices.

Superstruct’s ownership has also triggered controversy. Public pressure over investment ties to projects like the Coastal GasLink Pipeline and operations linked to the Israeli‑occupied West Bank led to boycott actions and the founders of Spain’s Sónar festival stepping down after decades of involvement.

What It Means for Fans and Artists

Industry analysts note that consolidation can bring operational efficiency and scale. But it can also mean:

- Higher ticket prices driven by market dominance.

- Fewer opportunities for independent promoters and smaller festivals.

- Programming that gravitates toward the most profitable acts, limiting diversity.

Artists themselves face a complex reality. Touring remains a major income source post‑pandemic, but dominant promoters can shape contract terms and pricing structures in ways that favor the biggest names.

The Policy Angle: What’s Being Proposed

Live DMA and Reset!’s report doesn’t just document ownership it feeds into a larger policy debate. European lawmakers and cultural advocates are being urged to consider limits on vertical integration and multi‑event ownership, which could reshape competition law as applied to cultural markets.

Some proposals discuss breaking up parts of aggregated assets or restricting acquisitions that reduce market options for independent promoters and venues. How regulators respond could be a bellwether for cultural policy across the EU.

Looking Ahead

Europe’s live music landscape is both a cultural treasure and a growing commercial powerhouse. The current ownership consolidation highlights a tension at the heart of that mix: how to balance scale with diversity, profitability with community value.

For festivalgoers, artists and independent organisers alike, the important question remains: what kind of music ecosystem do we want for the future? And who should have the power to shape it?