France’s music industry just posted another year of growth but not without a few surprises. Recorded music revenues climbed 3.4% year-over-year in the first half of 2025, reaching €432 million ($490 million), according to figures from SNEP, the National Syndicate of Phonographic Publishing. Yet, the data also shows cracks in the digital economy, with streaming video revenues plunging as audiences shift to short-form formats.

Slower Growth, Shifting Habits

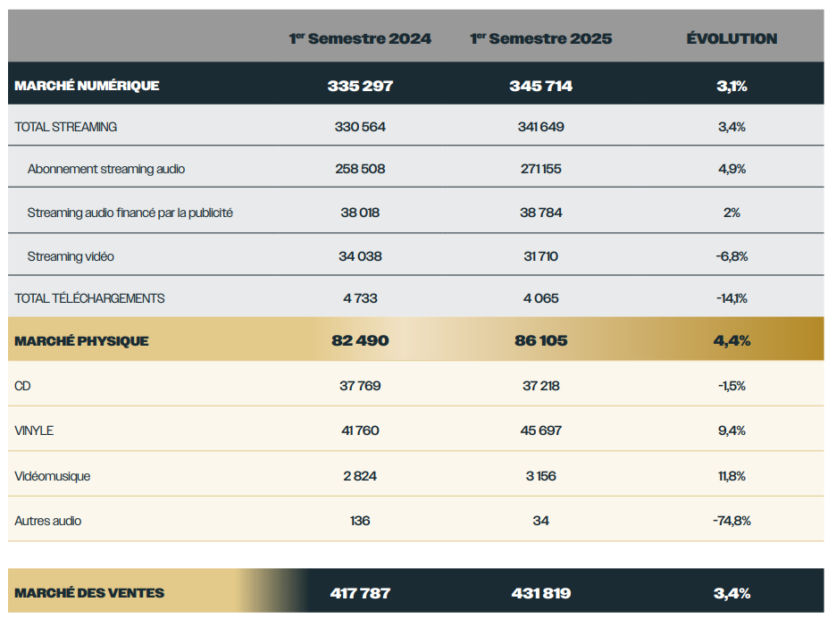

The 3.4% increase marks a slowdown from the 5.9% growth reported a year earlier. Digital revenues, which make up the bulk of France’s music market, grew 3.1% to €346 million ($393 million). Paid subscription streaming led the way, rising 3.9% to €271 million ($307 million), while ad-supported audio streaming ticked up 2% to €38.8 million ($40 million).

The weak spot was video streaming. Revenues dropped 6.8% to €31.7 million ($36 million), which SNEP linked to the decline of traditional music videos in favor of short clips and “visualizers” circulating on social platforms. “The music video segment is marked by the transformation of uses,” the group said in its latest report.

Vinyl Outpaces Digital

In an unexpected twist, physical formats outpaced digital growth. Total physical sales rose 4.4% to €86 million ($97.6 million), fueled by a 9.4% surge in vinyl, which hit €45.7 million ($51.8 million). CD sales, however, continued their slow slide, down 1.5% to €37.2 million ($42.2 million).

SNEP described the strength of physical formats as “a very positive signal for the diversity of music consumption methods.” Alexandre Lasch, SNEP’s Managing Director, added that France’s resilience “is based on the diversity of listening practices and the complementarity between physical sales and digital uses.”

The Streaming Challenge

Streaming remains the backbone of France’s music economy, accounting for 63% of total turnover. But SNEP cautions that France lags behind other major markets. Lasch framed the challenge as one of broadening appeal rather than just acquiring subscribers.

“We need to both retain younger generations, who favor short, fragmented formats, and attract an older audience that is still underrepresented on platforms,” he said. “By diversifying experiences and strengthening the perceived value of subscriptions, we can consolidate streaming’s place in everyone’s daily lives.”

Global players are facing the same issue. Spotify, for instance, has invested heavily in podcasts and audiobooks and is reportedly preparing a “super-premium” tier to diversify its subscriber base.

Local Music and European Regulation

Another key takeaway: French acts continue to dominate the charts. Three-quarters of the top 200 albums in the first half of 2025 were produced domestically, along with 16 of the 20 most-streamed tracks and more than half of the top 100 radio airplay songs.

Beyond consumer trends, regulatory developments also loom large. The European Union’s AI Act is rolling out, and SNEP signaled it will closely monitor how tech firms comply with copyright rules. The group also pushed for the creation of a licensing market for AI and music rightsholders.

“In our sights: the construction of a voluntary, ethical, and competitive licensing market, the only virtuous model capable of driving growth in both innovation and human creation,” SNEP said.

The Bigger Picture

France’s modest revenue growth highlights a balancing act: maintaining momentum in streaming while nurturing physical formats and local talent. The drop in video streaming revenues underscores how quickly consumer behavior can shift, while the rise of vinyl shows that old formats still hold cultural and economic weight.

The bigger question is whether France can catch up with global streaming leaders while protecting its cultural identity and rights holders in an era increasingly shaped by AI. The industry’s next steps could set an example for how music markets navigate both technological disruption and cultural preservation.