A Surprising Comeback for Europe’s Music Market

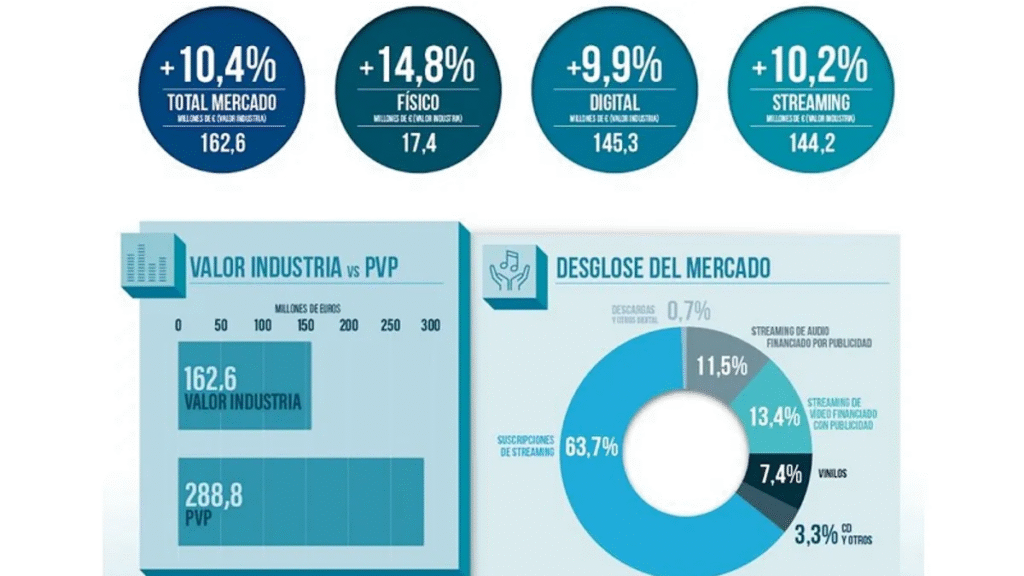

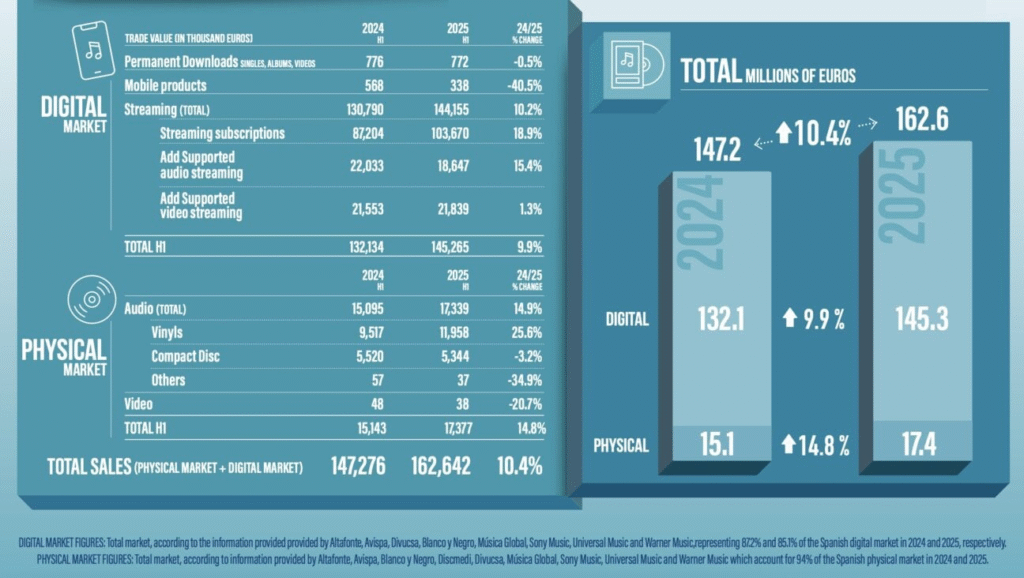

For years, the story in global recorded music has been one of steady but slowing growth. The U.S., Germany, and France all posted modest single-digit gains in the first half of 2025. Yet Spain has bucked the trend, delivering a striking 10.4% year-on-year increase in wholesale revenues reaching €162.6 million ($178 million).

The data, released by Promusicae, the trade body representing over 85% of Spain’s recording market, suggests that double-digit expansion in major European music markets isn’t a relic of the past.

Streaming Still Dominates But With Mixed Fortunes

Streaming continues to be the lifeblood of Spain’s music economy. Wholesale streaming revenues hit €144.2 million ($158 million) in the first half of 2025, up 10.2% year-on-year. But the headline figure hides a split between winners and losers.

- Subscription streaming surged 18.9%, generating €103.7 million ($113m). This was particularly notable given that Spotify had not raised its subscription prices in Spain during the period. (A €1-per-month increase rolled out in September 2025.)

- Ad-supported audio streaming fell sharply, down 15.4% to €18.6 million ($20m).

- Ad-supported video streaming managed only marginal growth, rising 1.3% to €21.8 million ($24m).

“Although the adoption of subscription models continues to grow, we are still far from the penetration rates of paid subscriptions seen in neighbouring countries,” noted Promusicae in its annual Radiography of the Recorded Music Market 2024 report.

The decline in ad-supported audio revenues echoes a broader European trend. Italy, for instance, saw ad-supported streaming volumes soar by more than 50% in 2024 while revenue barely grew, reflecting falling advertising rates.

Vinyl’s Remarkable Resilience

Despite the dominance of streaming, Spain’s physical music market is not only holding steady but growing. In H1 2025, physical sales climbed 14.8% year-on-year to €17.4 million ($19m).

That surge was almost entirely powered by vinyl, which jumped 25.6% to €12 million ($13m), now representing nearly 70% of all physical sales. CD sales, meanwhile, slipped 3.2% to €5.34 million.

Promusicae President Antonio Guisasola underscored this duality:

“It is more than confirmed that streaming is currently the main form of consumption sustaining the music market, although we must not forget that the public continues to show great interest in physical products, especially vinyl records.”

Spain in a Global Context

While Spain posted double-digit growth, other major markets lagged behind:

- United States: +0.9% YoY (H1 2025, per RIAA)

- Germany: +1.4% YoY

- France: +3.4% YoY

According to the IFPI Global Music Report 2025, Spain ranked as the world’s 14th largest music market in 2024. That’s a far cry from 2001, when it was seventh, a fall largely blamed on piracy. Yet the latest results show Spain clawing back relevance on the global stage.

The Challenges Ahead: AI, Taxes, and Sustainability

Even amid growth, structural challenges loom. Guisasola has warned that artificial intelligence poses a new threat to creators’ rights. He called for stronger state support:

“We need, in addition to maintaining public support, the commitment of public authorities to support and implement measures to support the sector, such as tax incentives for Spanish phonographic production, or ensuring that legislation in defence of intellectual property is enforced in relation to the use of protected works by AI developers.”

That balancing act between strong digital growth and safeguarding creative rights will define Spain’s next chapter.

What This Really Means

Spain’s music industry story in 2025 is one of contrasts. Subscription streaming is soaring, but ad-supported platforms are stagnating. Vinyl is thriving, but CDs continue to fade. Growth is back in double digits, but long-term challenges around piracy, AI, and market sustainability remain.

For now, Spain’s recorded music market is proving what many had written off: double-digit growth in Europe is still possible. The question is whether it can last.