Spotify’s Strong Quarter Ends in a Brutal Market Reversal

Spotify just reported a solid quarter with millions of new users and billions in revenue but Wall Street wasn’t impressed. On July 29, the company’s stock dropped 11.5%, wiping more than $16 billion off its market capitalization. The reason? A steep decline in projected operating income for Q3 and growing costs linked to share-based compensation taxes, known as “Social Charges.”

This surprising loss of investor confidence underscores a paradox in Spotify’s financial model: a rising stock price usually a good thing can also punch a hole in profits. Let’s break down how a fundamentally strong business landed in Wall Street’s bad books this week.

Section 1: Spotify’s Earnings Were Strong But Not Strong Enough

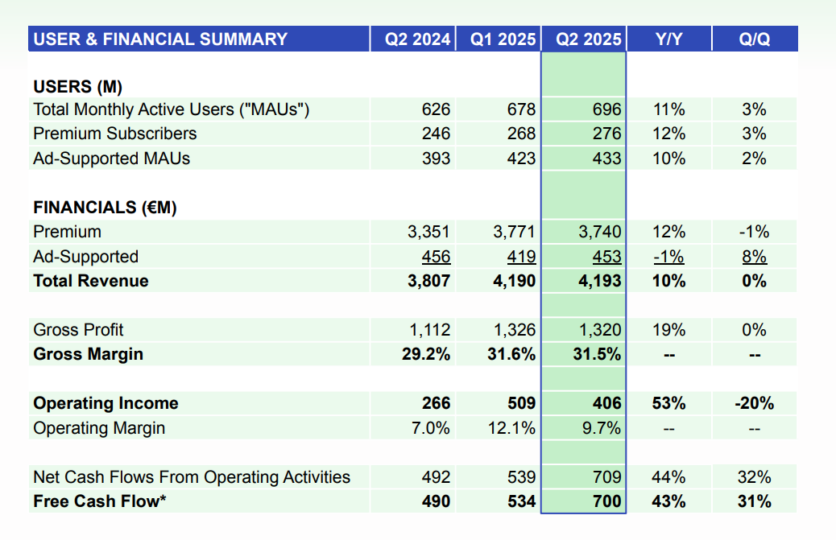

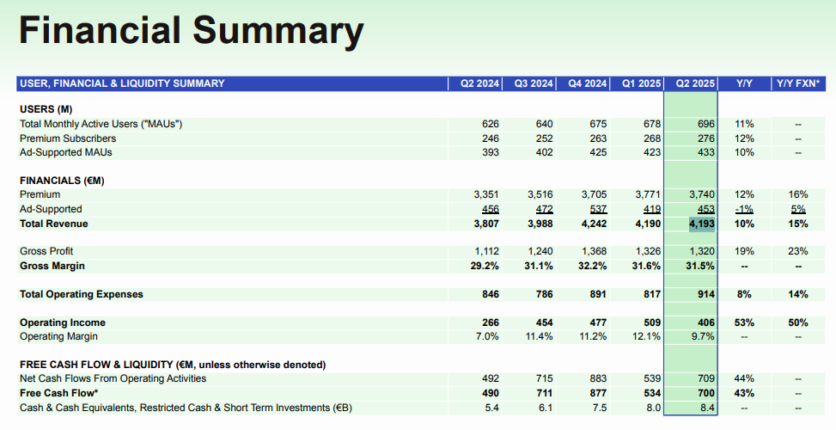

Spotify’s Q2 2025 results were, by most conventional measures, impressive.

- Premium subscribers: 276 million, up 8 million from Q1

- Monthly Active Users (MAUs): 696 million, up 18 million

- Revenue: €4.193 billion ($4.75bn), up 15% YoY (constant currency)

- Operating income: €406 million ($460m), up 50% YoY

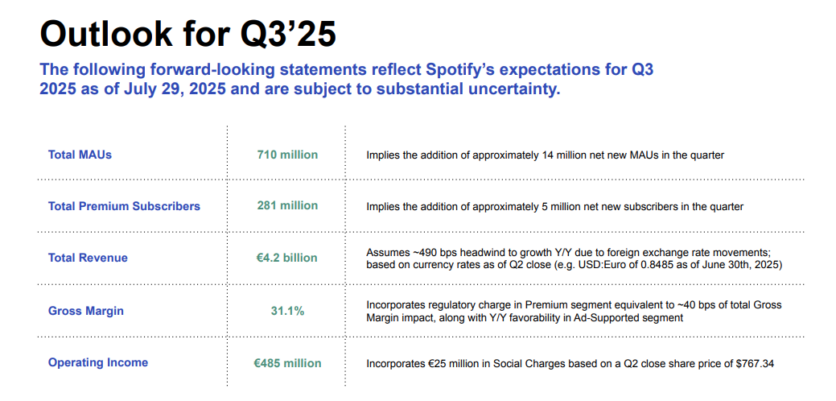

The problem? Expectations were higher. Analysts had forecast Q2 operating income closer to €460 million, and Spotify’s Q3 guidance €485 million missed the mark by €75 million.

And that miss came with a warning flag: rising “Social Charges.”

Section 2: What Are ‘Social Charges’ And Why Are They Crushing Profits?

Spotify defines Social Charges as payroll taxes tied to the value of employee stock-based compensation in countries where tax laws link such benefits to current share price. As Spotify’s stock more than doubled over the past year, these costs exploded.

- Q2 2025 Social Charges: €116 million ($132m)

- Expected Social Charges: €18 million

- Q2 2024 Social Charges: €58 million

In effect, Spotify underestimated how much its own success would cost.

Despite the strong underlying performance, these charges helped drag net income into the red: a net loss of €86 million ($97.5m), compared to €225 million in net income in Q1. Finance costs of €447 million ($507m) and tax expenses of €134 million ($152m) only made matters worse.

Section 3: Subscriber Growth and Regional Strength Remain Spotify’s Core Assets

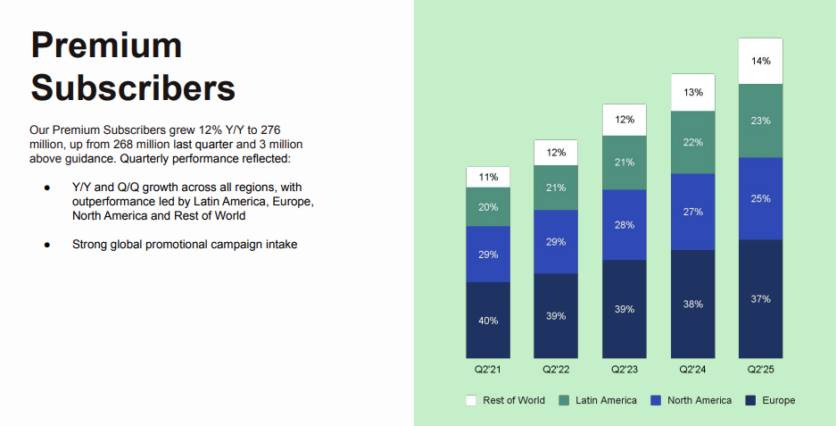

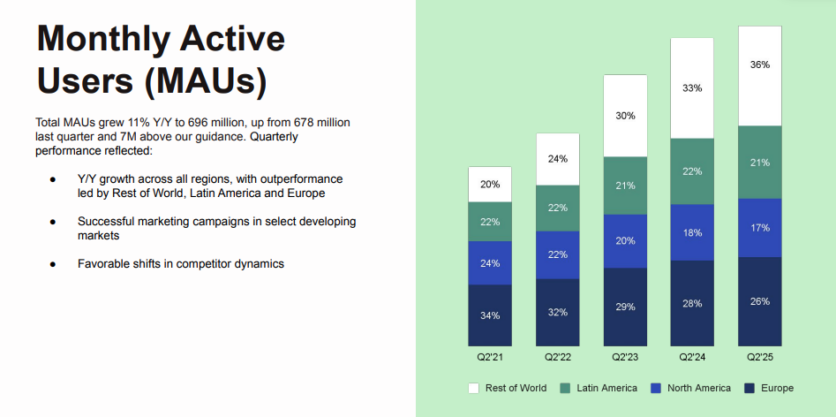

Even amid profit concerns, Spotify continues to scale its reach. The company exceeded subscriber and MAU guidance, powered by growth in Latin America, Europe, and North America.

Europe now represents 37% of Spotify’s premium base, while North America and Latin America contribute 25% and 23%, respectively.

Alex Norström, Chief Business Officer, summarized it:

“Over 3% of the world’s population subscribes to Spotify… it’s not implausible to imagine us reaching 10% or even 15%.”

Co-President Gustav Söderström backed that with share data:

“According to Luminate, 65% of global audio music streams now happen on Spotify.”

Those are dominant positions but they come with pressure to keep monetizing more effectively.

Section 4: Where’s Music Pro? Spotify Remains Vague on Super Premium Plans

Investors hoping for details on the long-rumored ‘Music Pro’ tier were left disappointed again. When asked directly about pricing strategies and superfan features, Norström said the company is building for the long term:

“We’re working towards these very high-value standards, and we’re making progress [on ‘Music Pro’] for sure, but it’s taking time.”

Instead, Spotify emphasized its audiobook add-on strategy, now live in 13 markets, and recent price increases in France, Belgium, Netherlands, and Luxembourg moves that, surprisingly, didn’t affect churn.

Section 5: AI and Multi-Format Content Are Changing the Spotify Experience

Spotify is investing heavily in AI-driven user personalization. Söderström pointed to the company’s AI DJ, playlist tools, and ability to parse natural language requests as game-changers for music discovery:

“Generative AI enables users to tell Spotify what they actually want… things that would have been impossible for us to understand from listening data.”

Video content and audiobooks are also surging:

- 400,000+ audiobooks available

- 430,000+ video podcasts on platform

- 350 million users have streamed video podcasts

- Video engagement growing 20x faster than audio-only

But whether this diversification is enhancing or cannibalizing music consumption is still up for debate.

Section 6: ‘Marketplace’ Monetization Raises Questions on Artist Fairness

Spotify CFO Christian Luiga hinted at expanding monetization models like the “Discovery Mode,” which allows artists to boost visibility in exchange for lower royalties. Critics call it a pay-to-play system.

The feature even came under fire in Drake’s lawsuit against Universal Music Group, where the program was painted as exploitative.

Luiga’s comment:

“[Gross margin gains could come from] how we monetize the marketplace in music.”

That could signal an expanded push into this controversial model without any concrete roadmap yet.

Section 7: Spotify Embraces À La Carte and a Potential iTunes Revival?

Spotify is reconsidering a move it once helped kill: paid music downloads.

CEO Daniel Ek said:

“You could imagine à la carte transactions being a very big potential driver for future revenue growth… The big media platforms of the future will have advertising, subscription, and à la carte.”

This signals Spotify might not just stream music it could soon sell it, along with books and digital products.

Conclusion: Growth and Volatility Go Hand-in-Hand at Spotify

Spotify’s Q2 earnings show a business scaling globally with enviable momentum. But it also shows the challenges of managing a fast-rising stock and complex international tax rules.

Spotify’s leadership remains confident in its long-term playbook. But the market wants clarity on profitability, AI monetization, pricing strategy and, yes, that elusive ‘Music Pro’ tier.

Until then, Wall Street’s reaction serves as a reminder: growth stories alone don’t cut it anymore. Investors want growth that sticks, and margins that hold.