Vietnam’s digital music scene is full of energy and potential, but the most recent data shows it still lags behind its Southeast Asian neighbors in commercial terms. In 2025, the country’s digital music revenue reached about US$51.95 million, making it the smallest market among six regional peers, according to a new Vietnam Music Landscape report by RMIT University Vietnam using Statista data.

Let’s break down what these figures mean for the industry, how consumers are engaging with digital music, and why there’s reason to believe this market could grow stronger in the years ahead.

Regional Context: A Market at the Back of the Pack

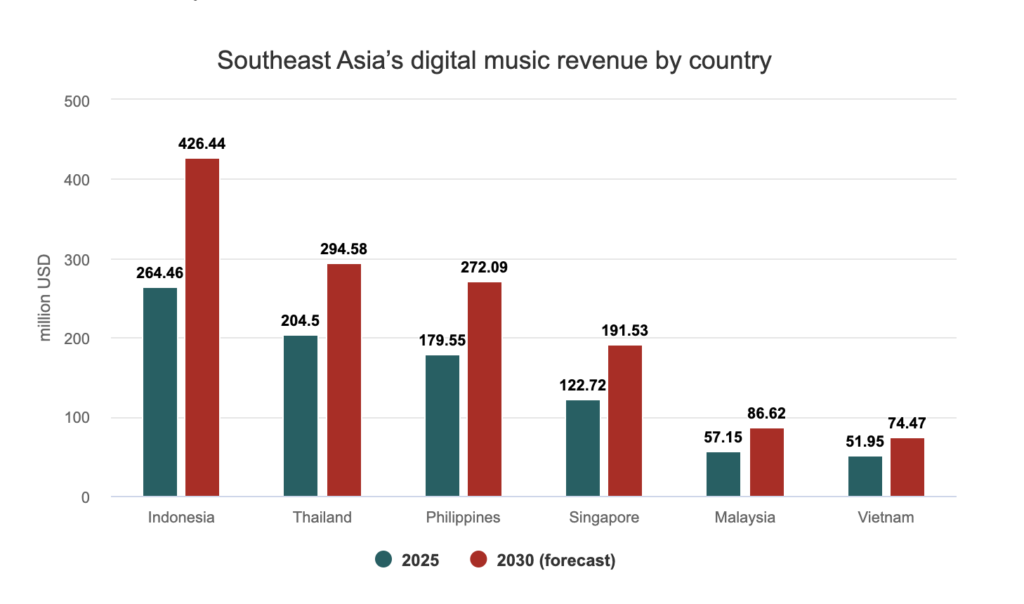

When placed side by side with neighboring countries, Vietnam’s digital music revenue is modest:

- Indonesia leads with around $264 million in revenue.

- Thailand, the Philippines, and Singapore each outperform Vietnam.

- Even Malaysia, a smaller market overall, posted higher figures.

Vietnam ranked sixth among the six Southeast Asian countries studied in the report.

That doesn’t mean growth isn’t happening. Statista projects the market could climb to roughly $74.47 million by 2030, driven by expanding streaming services and more local content. User numbers are also expected to rise, with Vietnam’s digital music audience projected at about 12.57 million people by 2030.

Consumer Habits: Platforms and Listening Patterns

Listening habits show Vietnam’s audience is active and engaged. According to the RMIT report:

- Users typically listen to music between one and two hours a day, with peak listening from 8 p.m. to 10 p.m.

- The most popular platforms YouTube, TikTok, and Spotify are all foreign‑owned, with domestic services like Zing MP3 and Nhac Cua Toi ranking lower.

This reflects a broader pattern seen in other analyses: YouTube remains the dominant music platform in Vietnam, often ahead of local services in terms of audience share.

Here’s the thing: a market isn’t defined only by raw revenue. User engagement and platform diversity indicate a vibrant ecosystem, even if monetization isn’t keeping pace with neighboring countries.

Live Music: A Bright Spot Beyond Streaming

It’s not just about digital streams. Last year, 810 live music events took place in Vietnam, and more than half of them drew crowds of 1,000 or more.

Packed venues aren’t rare, they’re becoming a trend. International acts like G‑DRAGON pulled nearly 100,000 concertgoers over two nights in November, and local star My Tam attracted about 40,000 in December. This hints at a deeper appetite for music experiences that go beyond screens and into real‑world cultural engagement.

Copyright Growth and Broader Creative Momentum

Vietnam’s digital music challenges aren’t limited to streaming revenue. Other metrics tell a different side of the story. According to the International Confederation of Societies of Authors and Composers (CISAC), Vietnam ranked among the top 10 in the Asia‑Pacific region for digital music copyright revenue in 2024, exceeding markets like Taiwan and Thailand.

This suggests that while absolute commercial music‑streaming dollars remain modest, Vietnam’s creative output and digital usage are gaining recognition across the region.

Why Size Isn’t the Whole Story

Here’s the thing: Vietnam’s digital music market might be the smallest in Southeast Asia right now, but it’s growing, engaged, and diversified. Streaming habits show strong user adoption, big live events show cultural demand, and copyright revenue growth signals creative vitality.

There’s a clear opportunity for local platforms and artists to build on this foundation. If the industry can convert listener engagement into sustainable revenue whether through better monetization strategies, more localized platforms, or deeper integration with global music ecosystems, Vietnam could soon redefine what success looks like for its digital music landscape.